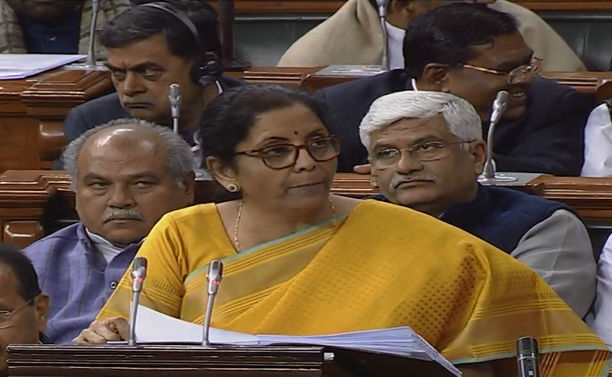

Finance Minister Smt Nirmala Sitharaman proposed a new taxation system to stimulate growth and simplify tax structure.

Here are the highlights from Nirmala Sitharaman’s Budget speech.

-

Personal Income Tax and Simplification of Taxation

The proposed changes in tax slabs are listed in the following table:

| Taxable Income Slab (Rs.) | Existing Tax Rates | New Tax Rates |

| 0-2.5 Lakh | Exempt | Exempt |

| 2.5-5 Lakh | 5% | 5% |

| 5-7.5 Lakh | 20% | 10% |

| 7.5-10 Lakh | 20% | 15% |

| 10-12.5 Lakh | 30% | 20% |

| 12.5-15 Lakh | 30% | 25% |

| Above 15 Lakh | 30% | 30% |

-

Dividend Distribution Tax

Finance Minister has proposed to remove DDT, and adopt the classical system of dividend taxation, under which the companies would not be required to pay DDT. The dividend shall be taxed only in the hands of the recipients at their applicable rate.

-

Concessional Tax Rate for Electricity Generation Companies

It has been proposed to extend the concessional corporate tax rate of 15% to new domestic companies engaged in the generation of electricity.

-

Tax Concession for Foreign Investments

100% tax exemption to their interest, dividend and capital gains income in respect of the investment made in infrastructure and other notified sectors before 31st March, 2024 and with a minimum lock-in period of 3 years.

-

Start-ups

- In order to give a boost to the start-up ecosystem, the Finance Minister has proposed to ease the burden of taxation on the employees by deferring the tax payment for five years or till they leave the company or when they sell their shares, whichever is earliest.

- Start-up having turnover upto 100 crore is allowed deduction of 100% on its profits for three consecutive assessment years out of 10 years if the total turnover does not exceed 100 crore rupees.

-

Concessional Tax Rate for Cooperatives

Cooperative societies to be taxed at 22% plus 10% surcharge and 4% cess with no exemptions/deductions.

-

Medium, Small and Micro Enterprises

Small retailers, traders, shopkeepers who comprise the MSME sector, raise by five times, the turnover threshold for audit from the existing Rs. 1 crore to Rs. 5 crore.

-

Affordable Housing

Deduction of upto 1.5 lakh for interest paid on loans taken for purchase of an affordable house till 31st March, 2021.

-

Charity Institutions

In order to claim the tax exemption, charity institutions have to be registered with the Income Tax Department.

-

Faceless Appeals

Amend the Income Tax Act so as to enable Faceless appeal on the lines of Faceless assessment.

-

‘Vivad se Vishwas’ scheme

A taxpayer would be required to pay only the amount of the disputed taxes and will get complete waiver of interest and penalty, provided he pays by 31st March, 2020.

-

Instant PAN through Aadhaar

PAN shall be instantly allotted online on the basis of Aadhaar, without any requirement for filling up of detailed application form.

-

Indirect Tax

-

GST

A simplified GST return shall be implemented from the 1st April, 2020. It will make return filing simple with features like SMS based filing for nil return, return pre-filling, improved input tax credit flow and overall simplification. Dynamic QR-code is proposed for consumer invoices. GST parameters will be captured when payment for purchases is made through the QR-code.

-

Source: https://pib.gov.in/newsite/PrintRelease.aspx?relid=197837, https://www.youtube.com/watch?v=NqLekhkNxi4&t=2342s